CDNS cuts profit rates for Short-Term Savings Certificates. New rates align with inflation trends ensuring stable secure investment options.

سنٹرل ڈائریکٹوریٹ آف نیشنل سیونگز نے شارٹ ٹرم سیونگ سرٹیفکیٹس کے لیے منافع کی شرح میں کمی کی ہے۔ نئی شرحیں افراط زر کے رجحانات کے ساتھ مطابقت رکھتی ہیں جو مستحکم محفوظ سرمایہ کاری کے اختیارات کو یقینی بناتی ہیں۔

Short-Term Savings Certificates December Update:

In December, the Federal Government released a recent update that the Central Directorate of National Savings reduced the Profit Rates on Short- Term Savings Certificates. This decision is a critical step toward decreasing the poverty rate in our nation. Short Term Savings Certificates are an accessible investment option for Pakistani citizens and overseas Pakistanis. These certificates allow deposits starting from as low as Rs.10,000 with no upper limit offering workability to investors. They can also be used as collateral for loans making them a practical financial tool.

دسمبر میں، وفاقی حکومت نے ایک حالیہ اپ ڈیٹ جاری کیا کہ سنٹرل ڈائریکٹوریٹ آف نیشنل سیونگز نے قلیل مدتی بچت کے سرٹیفکیٹس پر منافع کی شرح کو کم کر دیا۔ یہ فیصلہ ہماری قوم میں غربت کی شرح کو کم کرنے کی جانب ایک اہم قدم ہے۔ شارٹ ٹرم سیونگ سرٹیفکیٹس پاکستانی شہریوں اور بیرون ملک مقیم پاکستانیوں کے لیے قابل رسائی سرمایہ کاری کا آپشن ہیں۔ یہ سرٹیفکیٹس 10,000 روپے سے کم سے شروع ہونے والے ڈپازٹس کی اجازت دیتے ہیں جس کی کوئی اوپری حد سرمایہ کاروں کو لچک نہیں دیتی ہے۔ انہیں قرضوں کے لیے بطور ضمانت کے طور پر بھی استعمال کیا جا سکتا ہے جو انہیں ایک عملی مالیاتی آلہ بناتا ہے۔

On December 16, 2024, the Central Directorate of National Savings announced a reduction in the profit rates for these certificates. This change comes as a response to decreasing inflation rates and positive economic trends. The government efforts to align saving schemes with current economic conditions. These certificates remain an attractive option for individuals seeking secure short-term investments.

16 دسمبر 2024 کو سنٹرل ڈائریکٹوریٹ آف نیشنل سیونگز نے ان سرٹیفکیٹس کے منافع کی شرح میں کمی کا اعلان کیا۔ یہ تبدیلی افراط زر کی شرح میں کمی اور مثبت اقتصادی رجحانات کے ردعمل کے طور پر سامنے آئی ہے۔ حکومت بچتی اسکیموں کو موجودہ معاشی حالات کے ساتھ ہم آہنگ کرنے کی کوشش کر رہی ہے۔ محفوظ قلیل مدتی سرمایہ کاری کے خواہاں افراد کے لیے یہ سرٹیفکیٹس ایک پرکشش آپشن بنے ہوئے ہیں۔

Updated Profit Rates for December 2024 – Short-Term Savings Certificates:

The Central Directorate of National Savings (CDNS) has revised the profit rates for Short-Term Savings Certificates for December 2024, reflecting adjustments to align with current economic conditions.

Three-Month Certificates:

Previous Rate: 14.32% return, Rs. 3,580 profit per Rs. 100,000 investment.

Revised Rate: 12.76% return, Rs. 3,190 profit per Rs. 100,000 investment.

Six-Month Certificates:

Previous Rate: 13.46% return, Rs. 6,730 profit per Rs. 100,000 investment.

Revised Rate: 12.74% return, Rs. 6,370 profit per Rs. 100,000 investment.

One-Year Certificates:

Profit Rate: 12.38%, yielding Rs. 12,380 per Rs. 100,000 investment.

Increased Profit Tax for Non-Filers:

The profit earned from Short-Term Savings Certificates is taxed based on the investor’s tax filing status.

Active Taxpayer List (ATL) Filers:

Profit tax rate: 15% of the total yield. This lower rate applies to those who are compliant taxpayers and listed in the ATL.

Non-Filers:

Profit tax rate: 30% of the total yield. Non-filers, who are not on the ATL face a significantly higher tax burden as a penalty for not filing taxes.

Tax Changer to Support the Economy:

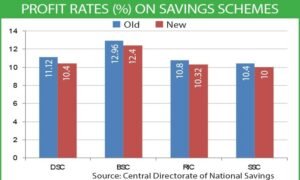

On December 11, the federal government made key adjustments to National Savings plans by reducing profit rates. These changes are aimed at aligning the savings instruments with prevailing economic conditions.

Updated Profit Rates: The profit rates on National Savings plans have been lowered, reflecting a shift in economic policies.

Purpose of Changes: The government aims to balance fiscal needs while offering investors competitive incentives. This move is part of broader efforts to support the economy by managing fiscal dynamics effectively.

Impact on Investors: Investors are encouraged to review the updated rates and adjust their savings strategies accordingly. While the rates have decreased, these plans remain a stable and secure investment option.

Profit Rate Drop from 16 Percent to 13.5 Percent:

Savings account profit rates have dropped from 16% to 13.5% a 250 basis point decrease. This reduction aligns with broader interest rate adjustments across multiple savings schemes.

Savings Account:

Profit rate decreased from 16% to 13.5%.

Other Schemes:

Regular income certificates and defence savings certificates now offer 12.1%, which has been lowered by 10 basis points.

Islamic Savings Account: The new rate is 10.44%, a drop of 72 basis points.

Sarwa Islamic Term & Savings Accounts: Profit rates adjusted similarly.

Conclusion:

The recent reduction in profit rates for Short-Term Savings Certificates reflects the government’s commitment to aligning financial policies with economic conditions. These certificates remain a reliable option for secure investments, offering flexibility and accessibility to individuals in Pakistan or abroad. Despite the rate adjustments, they provide a practical financial tool for managing savings and ensuring financial security.

FAQS:

Yes, these certificates are accessible to Pakistani citizens and overseas Pakistanis with no upper deposit limit. Filers (ATL): 15% tax on profits. Non-filers: 30% tax on profits. They allow a minimum deposit of Rs. 10,000, have no maximum limit and can be used as collateral for loans. The rates were adjusted to reflect declining inflation and align with economic policies to ensure fiscal balance and sustainability. Can overseas Pakistanis invest in Short-Term Savings Certificates?

What is the profit tax rate for filers and non-filers?

What are the benefits of these certificates?

Why were profit rates reduced?

Leave a Reply